Blogs, Online Business and Influencers in Malaysia Will Be Taxed

2 min readBlogs, Online Business and Influencers in Malaysia Will Be Taxed

Are you an online influencer in your blog, Youtube, Instagram, Twitter, Facebook or Snapchat based in Malaysia? Do you sell your items online in blogs, websites, Facebook, Twitter, Instagram, Ebay, Carousel or any other online platforms in Malaysia? If you are one of them then you will be taxed with the new guidelines from IRB (Inland Revenue Board Malaysia or LHDN, Lembaga Hasil Dalam Negeri Malaysia).

This is not a hoax and it is a new ruling from IRB and the official statement you can read at here (in Malay). http://www.hasil.gov.my/pdf/pdfam/Media_23052016_PENJELASAN_CUKAI_PENDAPATAN_PERNIAGAAN_ONLINE.pdf

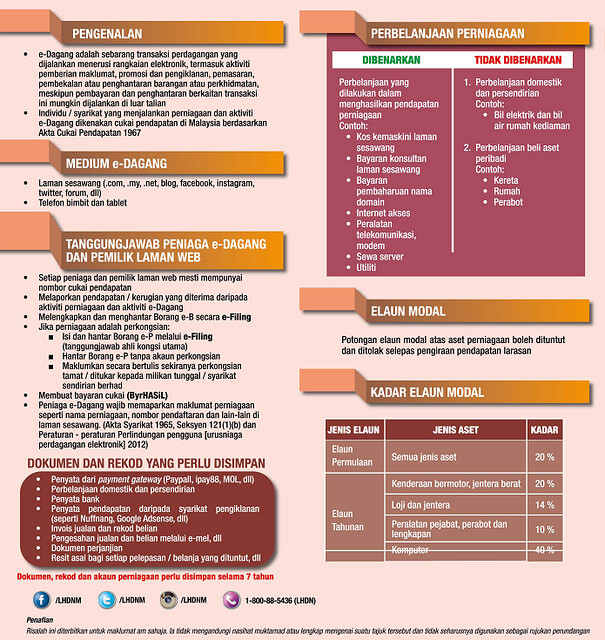

Well, you can read the statement but if you don’t understand how it works, we copied the images below from LHDN Facebook so you get a clearer understanding on how to pay your tax for your online business.

We know most bloggers blog for fun but with the new ruling, you need to open a new account at LHDN and it will be the Borang e-B from your e-Filling. For online business (registered company), you need to apply Borang e-P on e-Filling.

From now on, you need to declare all your income or your losses. Statements from Paypal, iPay88, MOL and others you will need to save and keep. Same goes to your receipts for your expenses, bank statements. Income statements from digital agencies such as Nuffnang, Google Adsense and others will not be spared. All your other source of income evidences such as contracts and emails, you need to keep that too.

Who will get taxed?

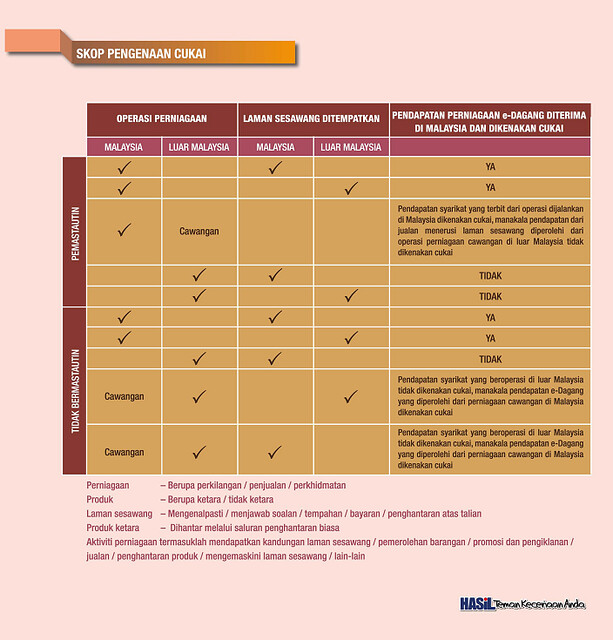

For online business or blogs operating in Malaysia you will be to open your tax account (even it is hosts outside of Malaysia). However, if your online business or blogs operating outside Malaysia, you will be exempted for taxes (even it is hosts in Malaysia). For blogs like us, we have regional readers so it is hard to determine our base. We have over 20% readers from Singapore and 50% readers from Malaysia and 30% readers from the rest of the world. In short, we need to declare our blog too.

Remember you need to save your statements, records and receipts up to 7 years from this year onwards. Since this is a new ruling, there will be more statements from LHDN on the tax structure and such. For more information or enquiries, please visit www.hasil.gov.my

If you want to read the Guidelines on Taxation on Electronic Commerce in English, visit http://www.hasil.gov.my/pdf/pdfam/GUIDELINES_ON_TAXATION_OF_ELECTRONIC_COMMERCE.pdf

For those who want to be a blogger, selling items online, online entrepreneur or social media influencer, you need to open a tax account and you might be subjected for taxes.

Since bloggers are now subjected for taxes, should companies be starting paying bloggers for their expenses and write ups instead of just sponsoring products and services? Time will tell.

Blogs, Online Business and Influencers in Malaysia Will Be Taxed: Blogs, Online Business and Influencers in M… https://t.co/qLAEahEUAZ

Blogs, Online Business and Influencers in Malaysia Will Be Taxed https://t.co/5x0oAggxz7

Blogs, Online Business and Online Influencers in Malaysia Will Be Taxed. This is a new ruling from LHDN (Lembaga… https://t.co/xZAxUOm9qG

Blogs, Online Business and Online Influencers in Malaysia Will Be Taxed. This is a new ruling from LHDN (Lembaga… https://t.co/WF19Xdtpo6

LOL, its like owning a Facebook account need to pay tax to play also? How do they know whether the $$$ is from advertisement? Receipt state donation can?

thanks for sharingnya, just found out that online business in Malaysia will be taxed